A basic way of assessing growth in a signal is to look at its

relative change over two neighboring time windows. The

epiprocess package provides a function

growth_rate() to compute such relative changes, as well as

more sophisticated estimates the growth rate of a signal. We investigate

this functionality in the current vignette, applied to state-level daily

reported COVID-19 cases from GA and PA, smoothed using a 7-day trailing

average.

The data is included in the epidatasets

package, which is loaded along with epiprocess, and can

be accessed with:

x <- cases_deaths_subset %>%

select(geo_value, time_value, cases = cases_7d_av) %>%

filter(geo_value %in% c("pa", "ga") & time_value >= "2020-06-01") %>%

arrange(geo_value, time_value)The data can also be fetched from the Delphi Epidata API with the following query:

library(epidatr)

d <- as.Date("2024-03-20")

x <- pub_covidcast(

source = "jhu-csse",

signals = "confirmed_7dav_incidence_num",

geo_type = "state",

time_type = "day",

geo_values = "ga,pa",

time_values = epirange(20200601, 20211231),

as_of = d

) %>%

select(geo_value, time_value, cases = value) %>%

arrange(geo_value, time_value) %>%

as_epi_df(as_of = d)The data has 1,158 rows and 3 columns.

Growth rate basics

The growth rate of a function defined over a continuously-valued parameter is defined as , where is the derivative of at . To estimate the growth rate of a signal in discrete-time (which can be thought of as evaluations or discretizations of an underlying function in continuous-time), we can estimate the derivative and divide by the signal value itself (or possibly a smoothed version of the signal value).

The growth_rate() function takes a sequence of

underlying design points x and corresponding sequence

y of signal values, and allows us to choose from the

following methods for estimating the growth rate at a given reference

point x0, by setting the method argument:

- “rel_change”: uses

,

where

is the average of

yover the second half of a sliding window of bandwidthhcentered at the reference pointx0, and the average over the first half. This can be seen as using a first-difference approximation to the derivative. - “linear_reg”: uses the slope from a linear regression of

yonxover a sliding window centered at the reference pointx0, divided by the fitted value from this linear regression atx0. - “smooth_spline”: uses the estimated derivative at

x0from a smoothing spline fit toxandy, viastats::smooth.spline(), divided by the fitted value of the spline atx0. - “trend_filter”: uses the estimated derivative at

x0from polynomial trend filtering (a discrete spline) fit toxandy, viatrendfilter::trendfilter(), divided by the fitted value of the discrete spline atx0.

The default in growth_rate() is x0 = x, so

that it returns an estimate of the growth rate at each underlying design

point.

Relative change

The default method is “rel_change”, which is the simplest way to

estimate growth rates. The default bandwidth is h = 7,

which for daily data, considers the relative change in a signal over

adjacent weeks. We can wrap growth_rate() in a call to

dplyr::mutate() to append a new column to our

epi_df object with the computed growth rates.

x <- x %>%

group_by(geo_value) %>%

mutate(cases_gr1 = growth_rate(cases))

head(x, 10)

#> An `epi_df` object, 10 x 4 with metadata:

#> * geo_type = state

#> * time_type = day

#> * as_of = 2024-03-20

#>

#> # A tibble: 10 × 4

#> # Groups: geo_value [1]

#> geo_value time_value cases cases_gr1

#> <chr> <date> <dbl> <dbl>

#> 1 ga 2020-06-01 643. 0.00601

#> 2 ga 2020-06-02 603. 0.0185

#> 3 ga 2020-06-03 608 0.0240

#> 4 ga 2020-06-04 656. 0.0218

#> 5 ga 2020-06-05 677. 0.0193

#> 6 ga 2020-06-06 718. 0.0163

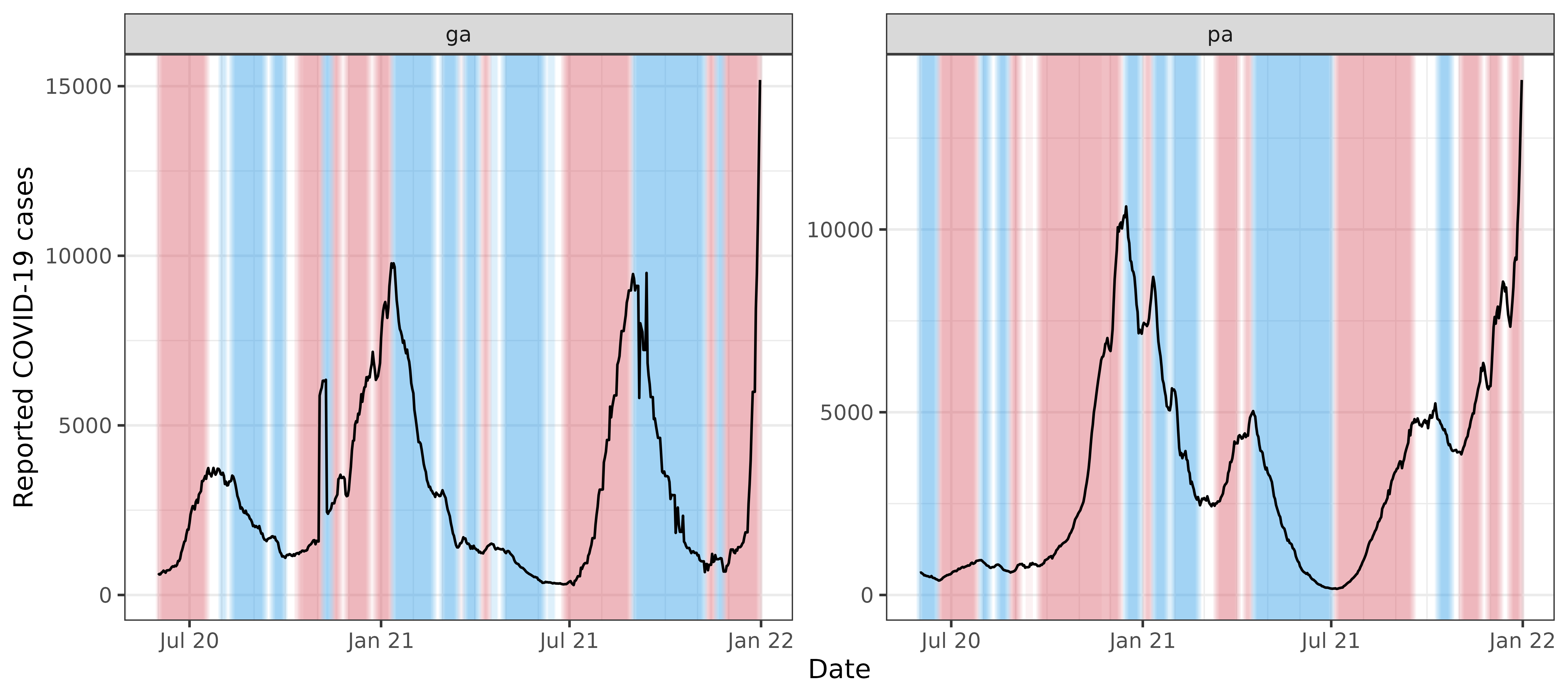

#> # ℹ 4 more rowsWe can visualize these growth rate estimates by plotting the signal values and highlighting the periods in time for which the relative change is above 1% (in red) and below -1% (in blue), faceting by geo value.

library(ggplot2)

upper <- 0.01

lower <- -0.01

ggplot(x, aes(x = time_value, y = cases)) +

geom_tile(

data = x %>% filter(cases_gr1 >= upper),

aes(x = time_value, y = 0, width = 7, height = Inf),

fill = 2, alpha = 0.08

) +

geom_tile(

data = x %>% filter(cases_gr1 <= lower),

aes(x = time_value, y = 0, width = 7, height = Inf),

fill = 4, alpha = 0.08

) +

geom_line() +

facet_wrap(vars(geo_value), scales = "free_y") +

scale_x_date(minor_breaks = "month", date_labels = "%b %y") +

labs(x = "Date", y = "Reported COVID-19 cases")

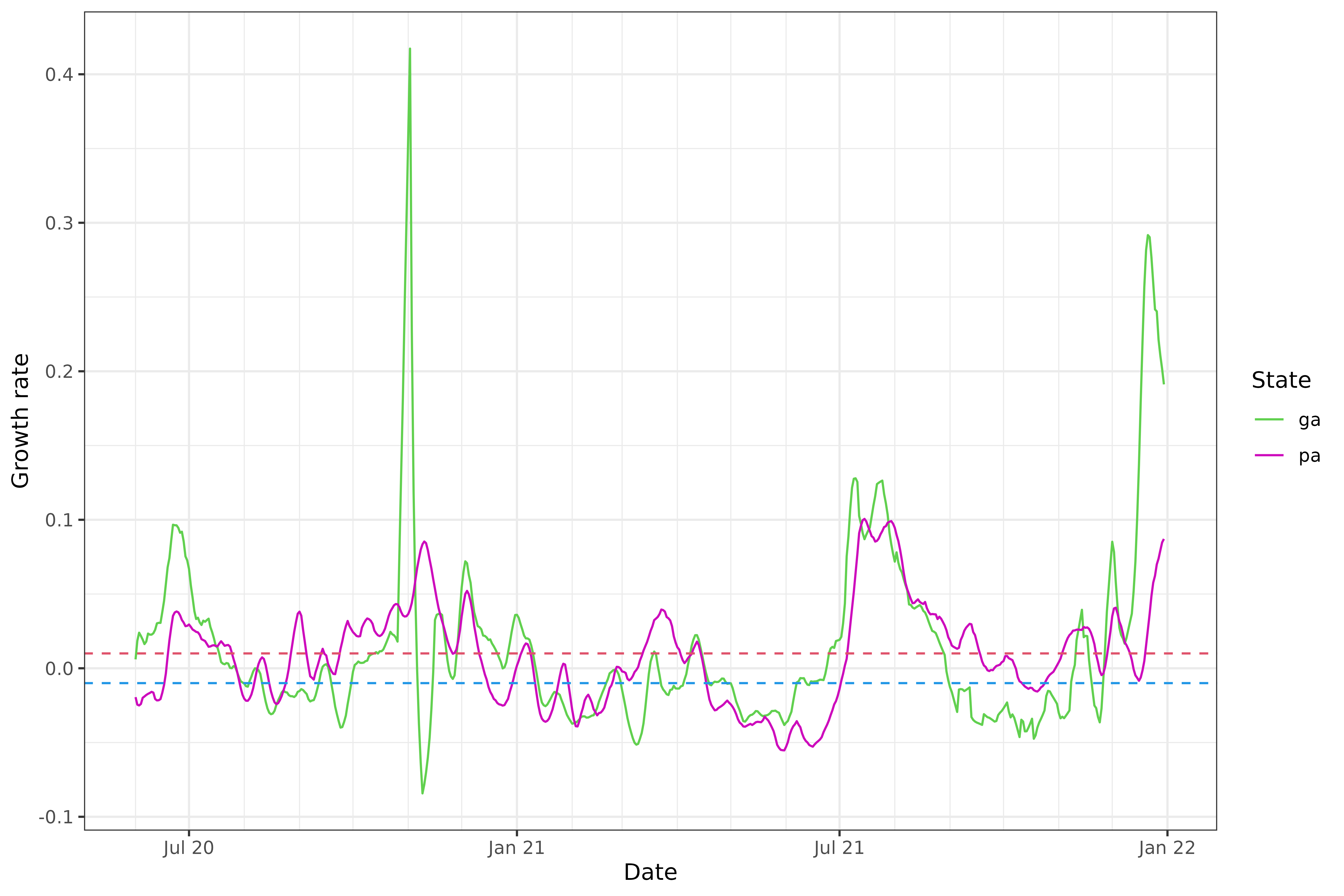

As a more direct visualization, we plot the estimated growth rates themselves, overlaying the curves for the two states on one plot.

ggplot(x, aes(x = time_value, y = cases_gr1)) +

geom_line(aes(col = geo_value)) +

geom_hline(yintercept = upper, linetype = 2, col = 2) +

geom_hline(yintercept = lower, linetype = 2, col = 4) +

scale_color_manual(values = c(3, 6)) +

scale_x_date(minor_breaks = "month", date_labels = "%b %y") +

labs(x = "Date", y = "Growth rate", col = "State")

We can see that the estimated growth rates from the relative change method are somewhat volatile, and there appears to be some bias towards towards the right boundary of the time span—look at the estimated growth rate for Georgia in late December 2021, which takes a potentially suspicious dip. In general, estimation of derivatives will be difficult near the boundary, but relative changes can suffer from particularly noticeable boundary bias because they are based on a difference in averages over two halves of a local window, and with this simplistic approach, one of these halves will be truncated near a boundary.

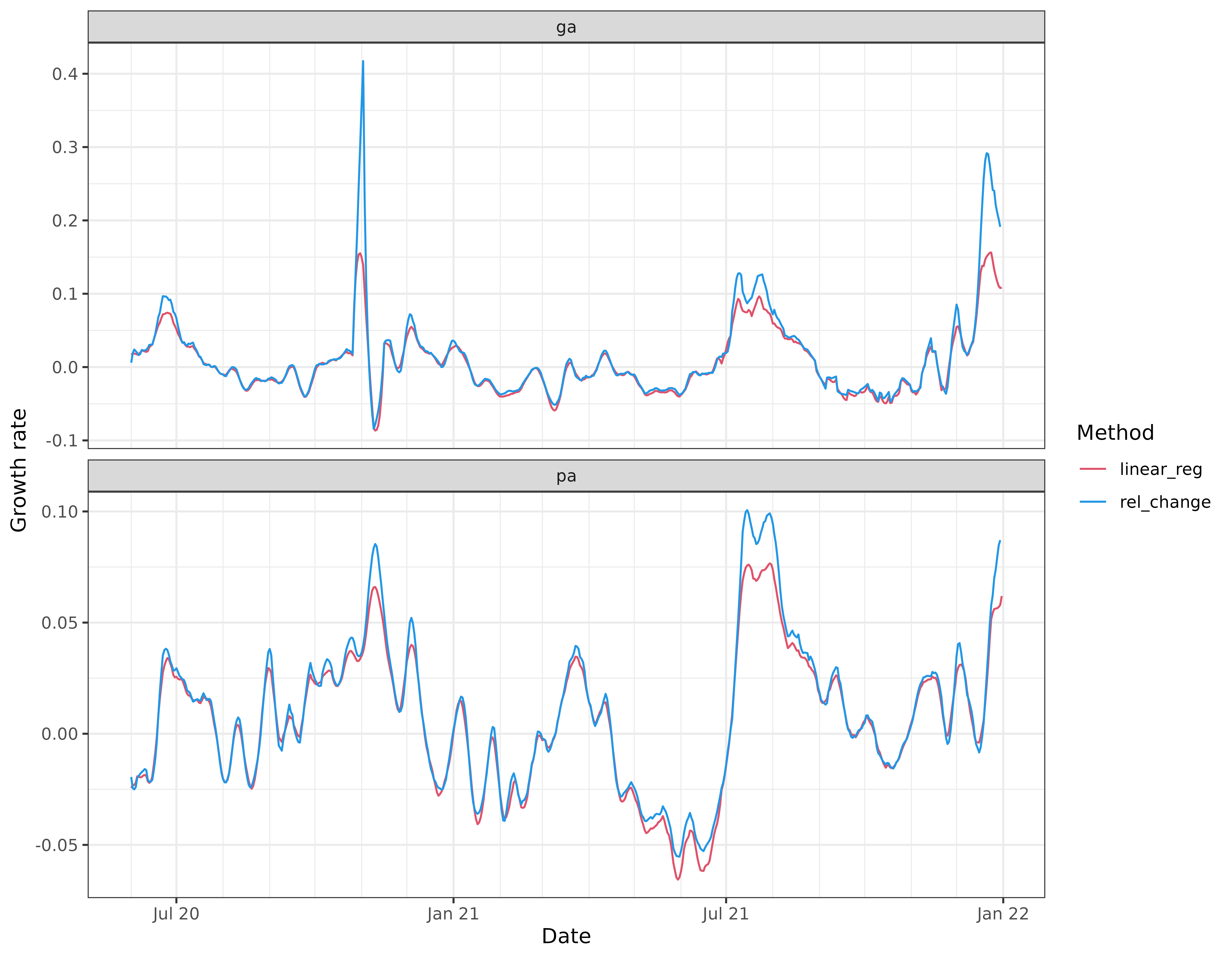

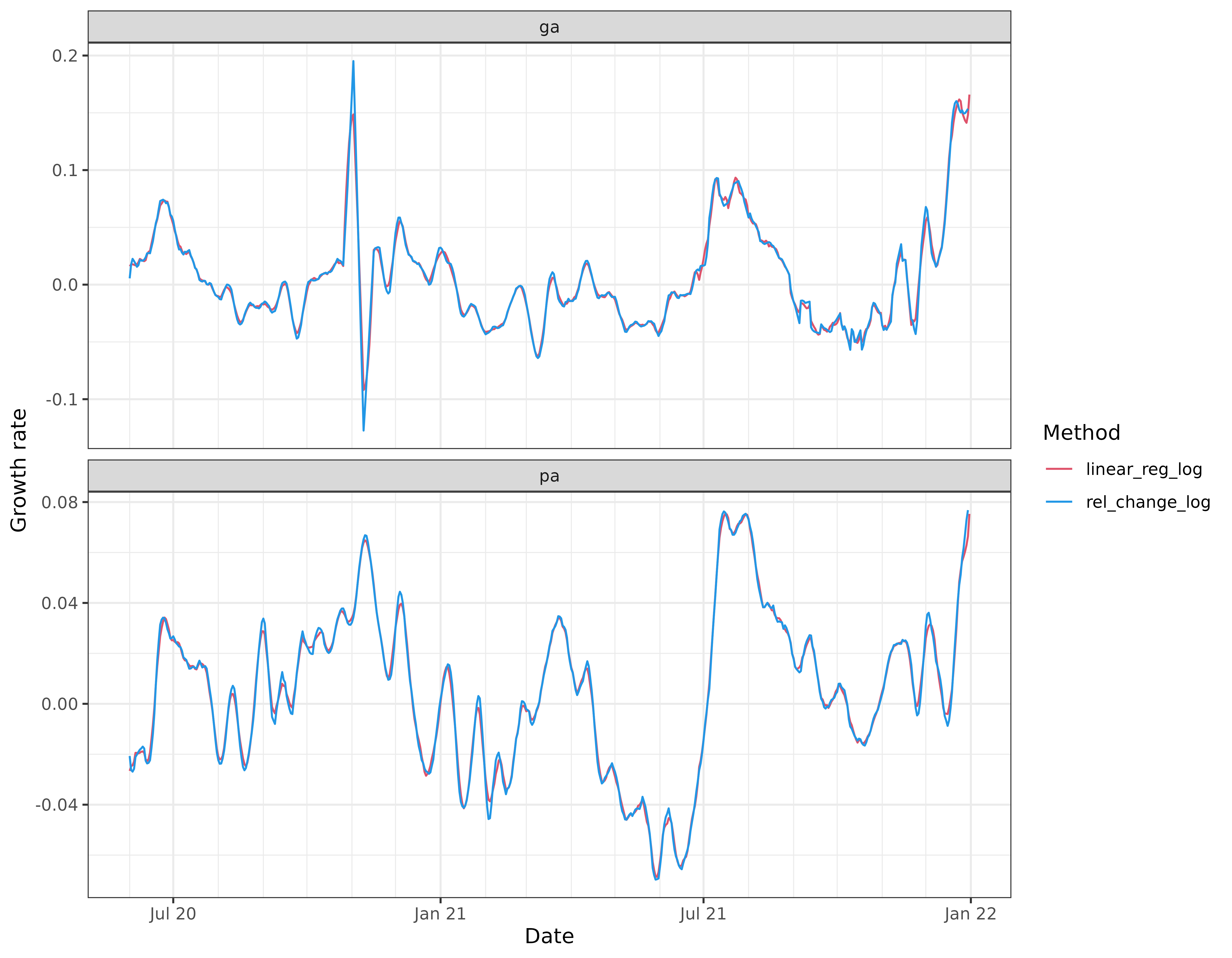

Linear regression

The second simplest method available is “linear_reg”, whose default

bandwidth is again h = 7. Compared to “rel_change”, it

appears to behave similarly overall, but thankfully avoids some of the

troublesome spikes:

x <- x %>%

group_by(geo_value) %>%

mutate(cases_gr2 = growth_rate(cases, method = "linear_reg"))

x %>%

pivot_longer(

cols = starts_with("cases_gr"),

names_to = "method",

values_to = "gr"

) %>%

mutate(method = recode(method,

cases_gr1 = "rel_change",

cases_gr2 = "linear_reg"

)) %>%

ggplot(aes(x = time_value, y = gr)) +

geom_line(aes(col = method)) +

scale_color_manual(values = c(2, 4)) +

facet_wrap(vars(geo_value), scales = "free_y", ncol = 1) +

scale_x_date(minor_breaks = "month", date_labels = "%b %y") +

labs(x = "Date", y = "Growth rate", col = "Method")

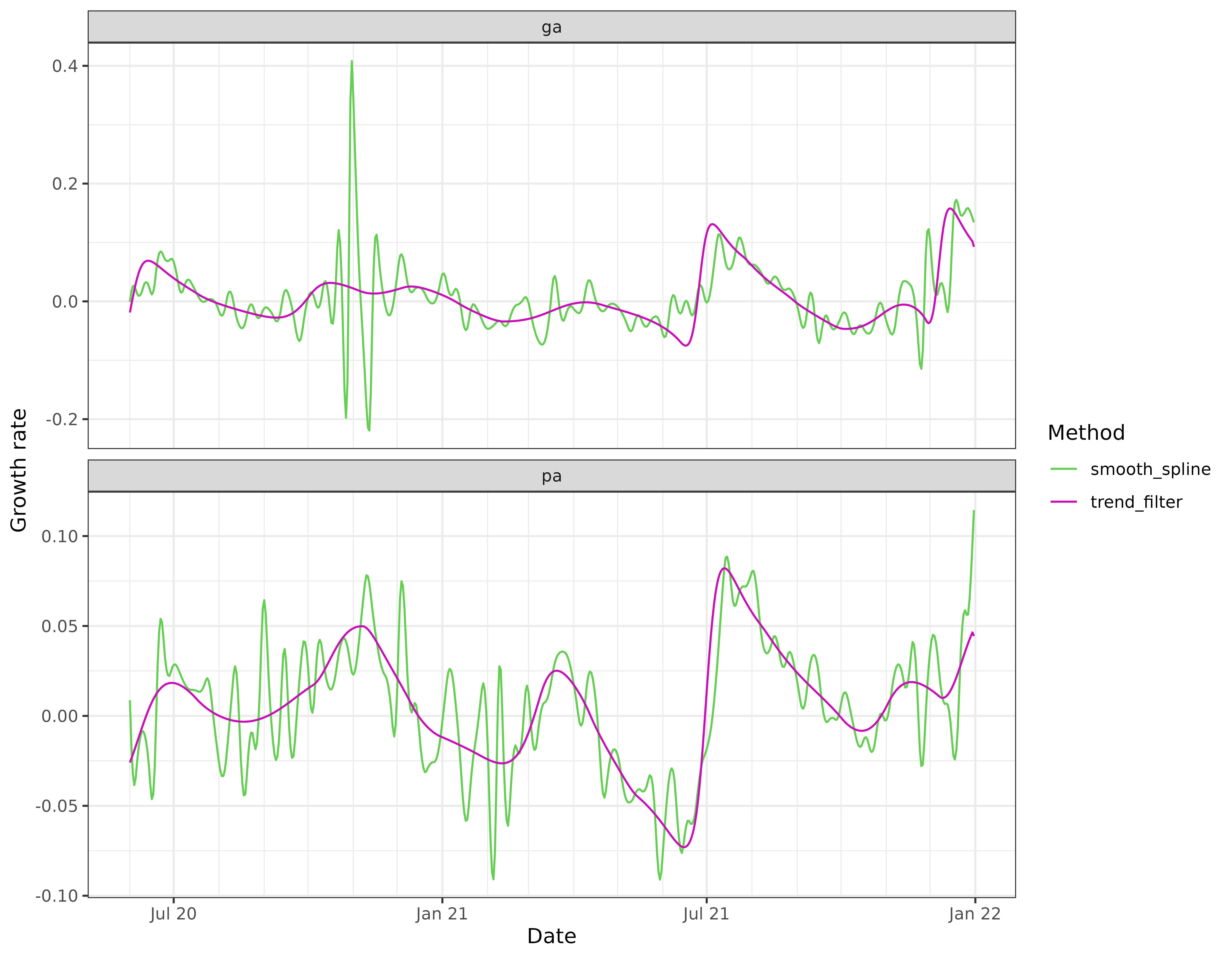

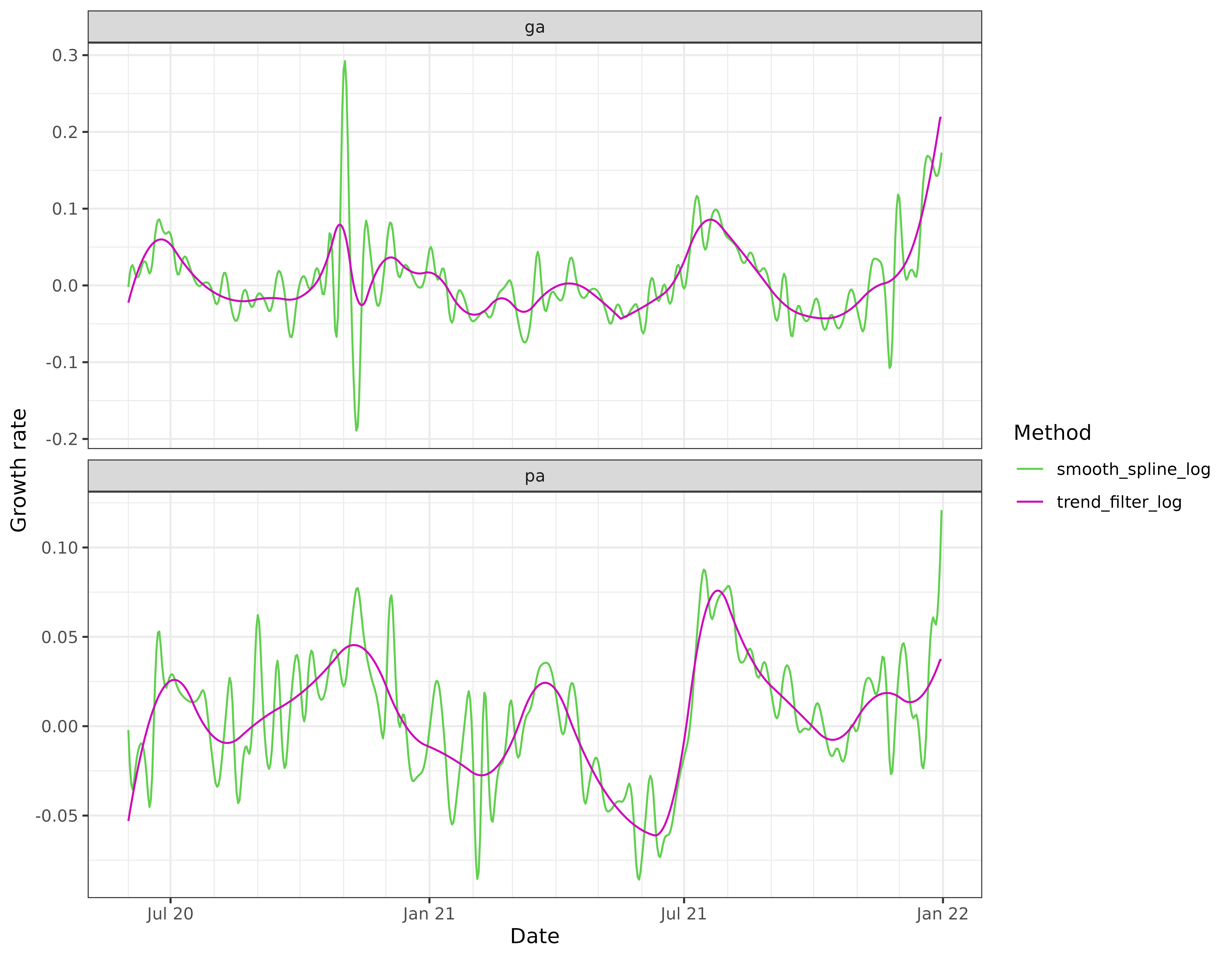

Nonparametric estimation

We can also use a nonparametric method to estimate the derivative,

through “smooth_spline” or “trend_filter”. The latter is going to be

generally more computationally expensive, but it is also able to adapt

better to the local level of smoothness. (The apparent efficiency is

actually compounded by the particular implementations and default

settings for these methods: “trend_filter” is based on a sequence of

solutions provided in the trendfilter package, and performs

cross-validation by default in order to pick the level of

regularization; read the documentation for growth_rate()

for more details.)

Note: The trendfilter package is not automatically

installed with epiprocess. To install it from GitHub, you

can use pak::pkg_install("glmgen/trendfilter").

x <- x %>%

group_by(geo_value) %>%

mutate(

cases_gr3 = growth_rate(cases, method = "smooth_spline"),

cases_gr4 = growth_rate(cases, method = "trend_filter")

)

x %>%

select(geo_value, time_value, cases_gr3, cases_gr4) %>%

pivot_longer(

cols = starts_with("cases_gr"),

names_to = "method",

values_to = "gr"

) %>%

mutate(method = recode(method,

cases_gr3 = "smooth_spline",

cases_gr4 = "trend_filter"

)) %>%

ggplot(aes(x = time_value, y = gr)) +

geom_line(aes(col = method)) +

scale_color_manual(values = c(3, 6)) +

facet_wrap(vars(geo_value), scales = "free_y", ncol = 1) +

scale_x_date(minor_breaks = "month", date_labels = "%b %y") +

labs(x = "Date", y = "Growth rate", col = "Method")

In this particular example, the trend filtering estimates of growth rate appear to be much more stable than those from the smoothing spline, and also much more stable than the estimates from local relative changes and linear regressions.

The smoothing spline growth rate estimates are based on the default

settings in stats::smooth.spline(), and appear severely

under-regularized here. Any of the arguments to

stats::smooth.spline() can be customized by passing them as

additional arguments to growth_rate_params(); similarly, we

can also use additional arguments to customize the settings in the

underlying trend filtering functions

trendfilter::trendfilter(),

trendfilter::cv_trendfilter(), and the documentation for

growth_rate() gives the full details.

Log scale estimation

In general, and alternative view for the growth rate of a function

is given by defining

,

and then observing that

.

Therefore, any method that estimates the derivative can be simply

applied to the log of the signal of interest, and in this light, each

method above (“rel_change”, “linear_reg”, “smooth_spline”, and

“trend_filter”) has a log scale analog, which can be used by setting the

argument log_scale = TRUE in the call to

growth_rate().

x <- x %>%

group_by(geo_value) %>%

mutate(

cases_gr5 = growth_rate(cases, method = "rel_change", log_scale = TRUE),

cases_gr6 = growth_rate(cases, method = "linear_reg", log_scale = TRUE),

cases_gr7 = growth_rate(cases, method = "smooth_spline", log_scale = TRUE),

cases_gr8 = growth_rate(cases, method = "trend_filter", log_scale = TRUE)

)

x %>%

select(geo_value, time_value, cases_gr5, cases_gr6) %>%

pivot_longer(

cols = starts_with("cases_gr"),

names_to = "method",

values_to = "gr"

) %>%

mutate(method = recode(method,

cases_gr5 = "rel_change_log",

cases_gr6 = "linear_reg_log"

)) %>%

ggplot(aes(x = time_value, y = gr)) +

geom_line(aes(col = method)) +

scale_color_manual(values = c(2, 4)) +

facet_wrap(vars(geo_value), scales = "free_y", ncol = 1) +

scale_x_date(minor_breaks = "month", date_labels = "%b %y") +

labs(x = "Date", y = "Growth rate", col = "Method")

x %>%

select(geo_value, time_value, cases_gr7, cases_gr8) %>%

pivot_longer(

cols = starts_with("cases_gr"),

names_to = "method",

values_to = "gr"

) %>%

mutate(method = recode(method,

cases_gr7 = "smooth_spline_log",

cases_gr8 = "trend_filter_log"

)) %>%

ggplot(aes(x = time_value, y = gr)) +

geom_line(aes(col = method)) +

scale_color_manual(values = c(3, 6)) +

facet_wrap(vars(geo_value), scales = "free_y", ncol = 1) +

scale_x_date(minor_breaks = "month", date_labels = "%b %y") +

labs(x = "Date", y = "Growth rate", col = "Method")

Comparing the rel_change_log curves with their

rel_change counterparts (shown in earlier figures), we see

that the former curves appear less volatile and match the linear

regression estimates much more closely. In particular, when

rel_change has upward spikes, rel_change_log

has less pronounced spikes. Why does this occur? The estimate of

here can be expressed as

,

where

,

and the expectation refers to averaging over the

observations in each window. Consider the following two relevant

inequalities, both due to concavity of the logarithm function:

The first inequality is Jensen’s; the second inequality is because

the tangent line of a concave function lies above it. Finally, we

observe that

,

which the rel_change estimate. This explains why the

rel_change_log curve often lies below the

rel_change curve.

Attribution

This document contains a dataset that is a modified part of the COVID-19 Data Repository by the Center for Systems Science and Engineering (CSSE) at Johns Hopkins University as republished in the COVIDcast Epidata API. This data set is licensed under the terms of the Creative Commons Attribution 4.0 International license by the Johns Hopkins University on behalf of its Center for Systems Science in Engineering. Copyright Johns Hopkins University 2020.

From the COVIDcast Epidata API: These signals are taken directly from the JHU CSSE COVID-19 GitHub repository without changes.